Meal Money Update and our proposal - 11.23.2024

Dear Fellow House Officers,

Below is in an important update on meal money:

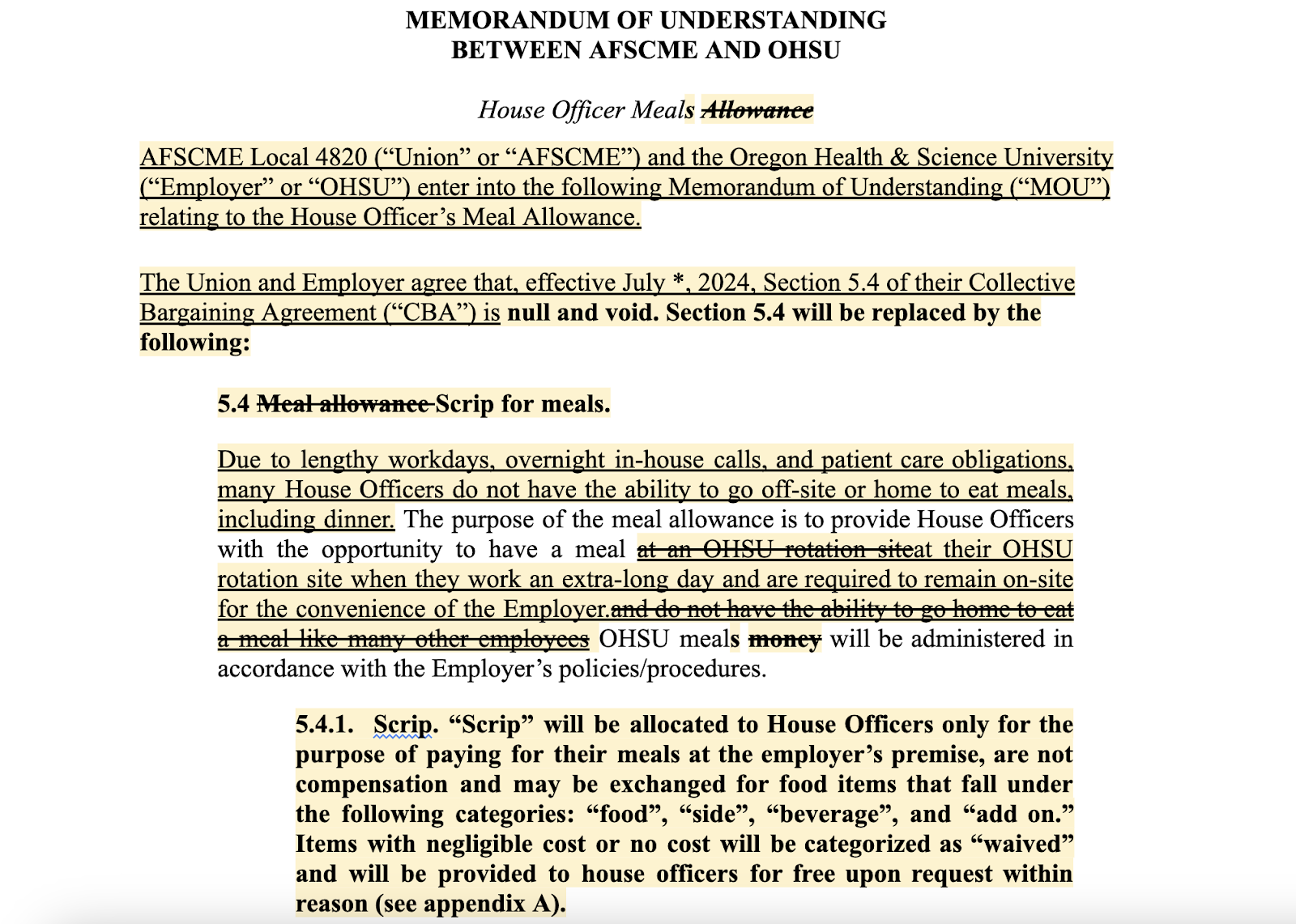

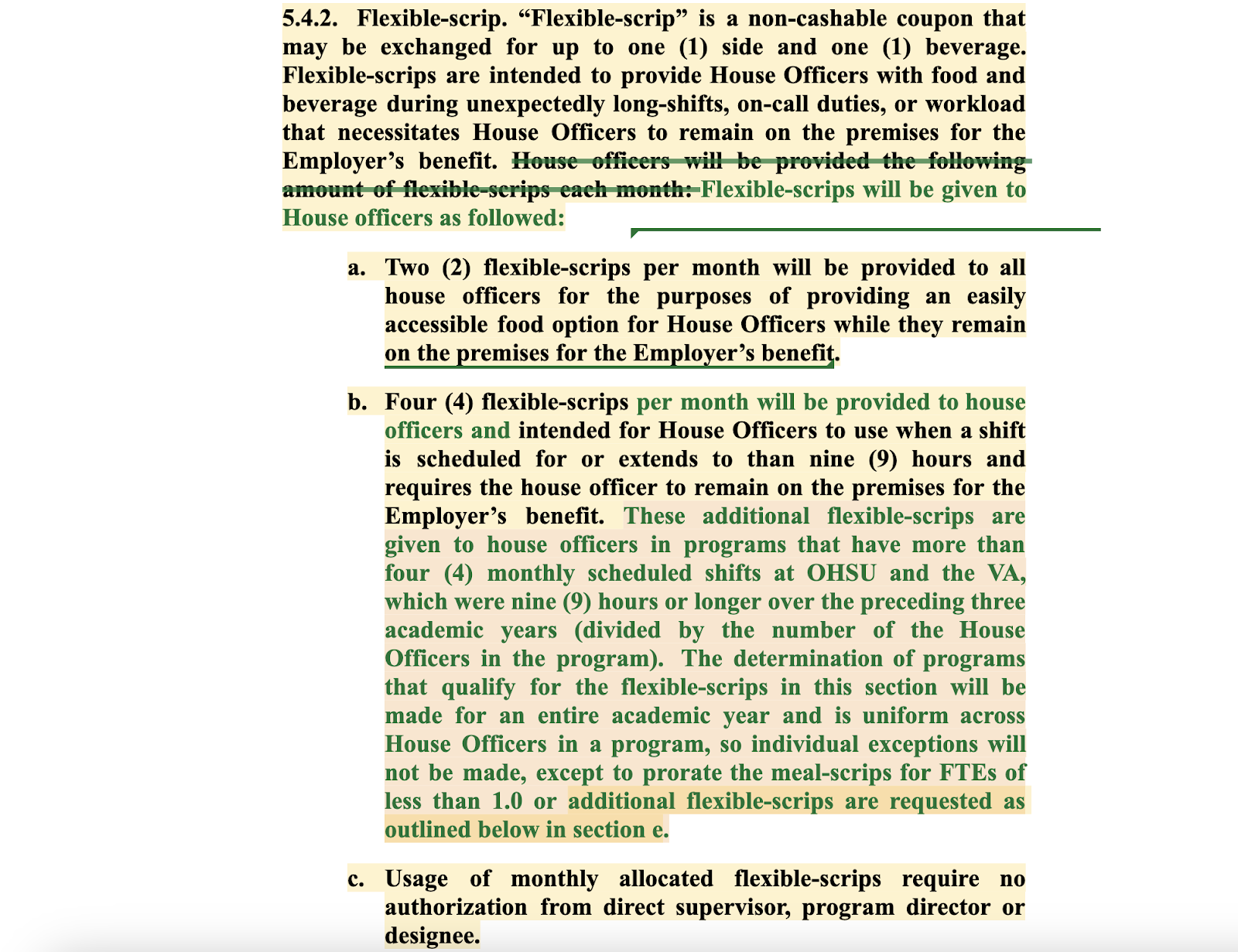

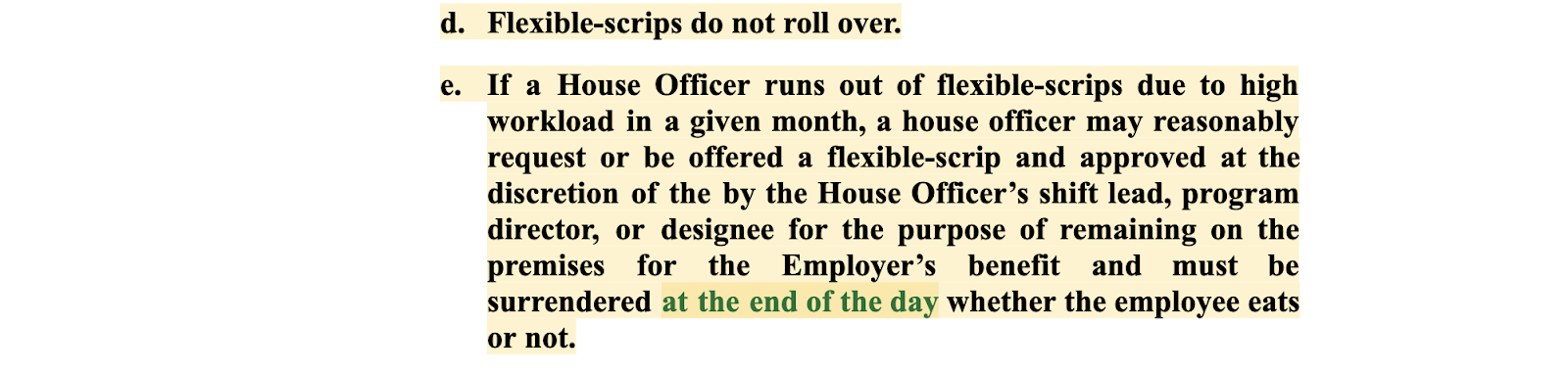

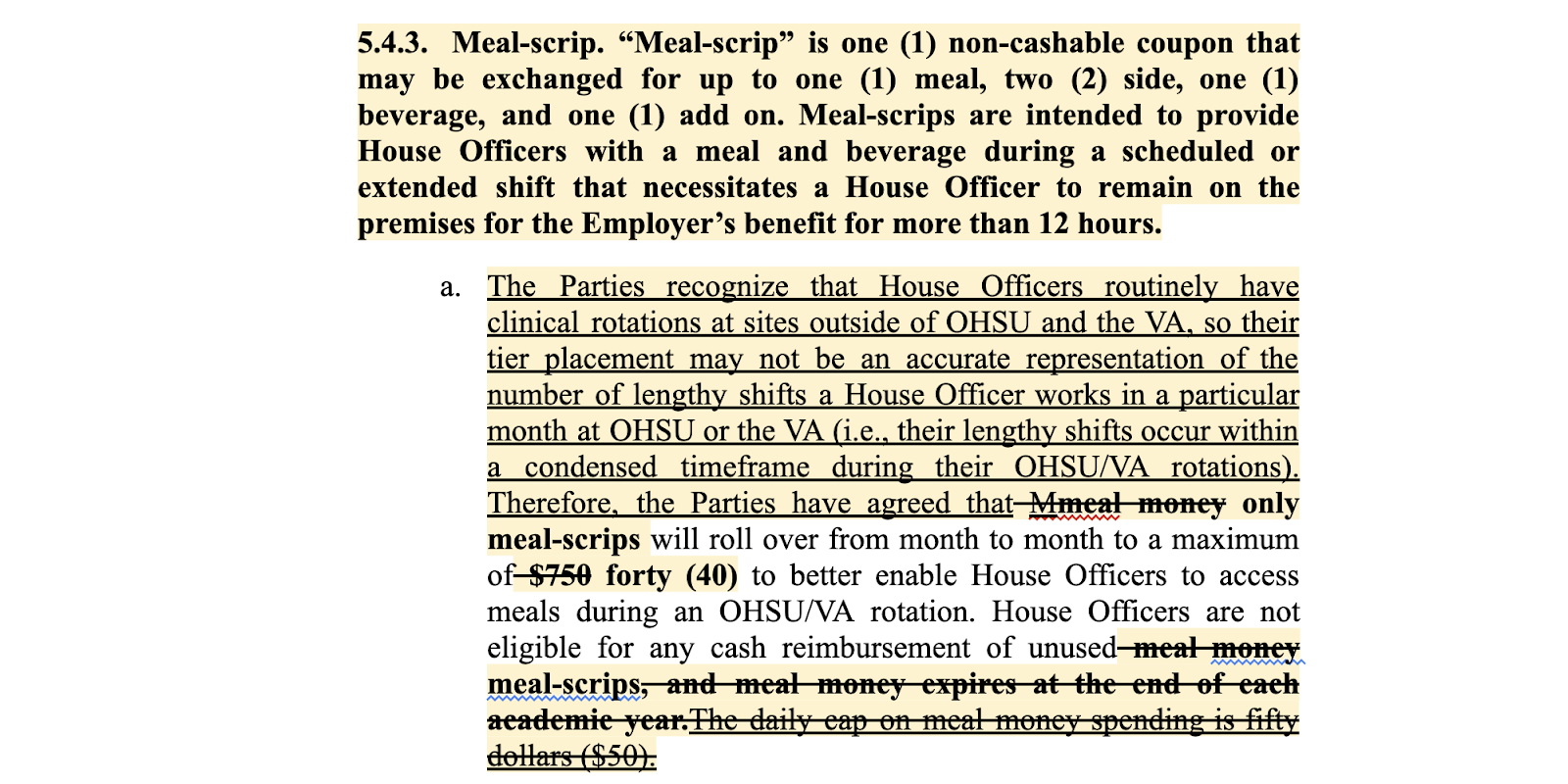

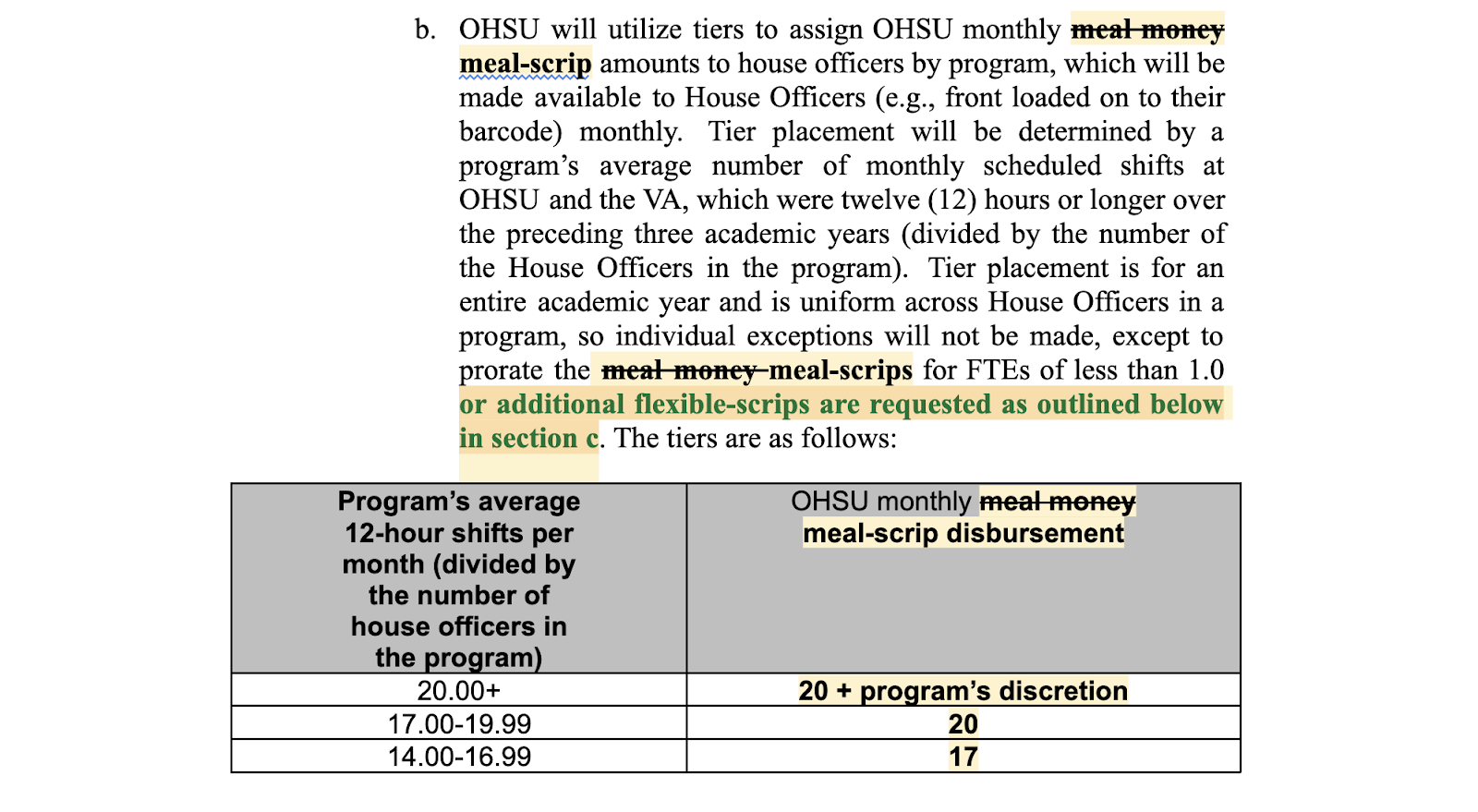

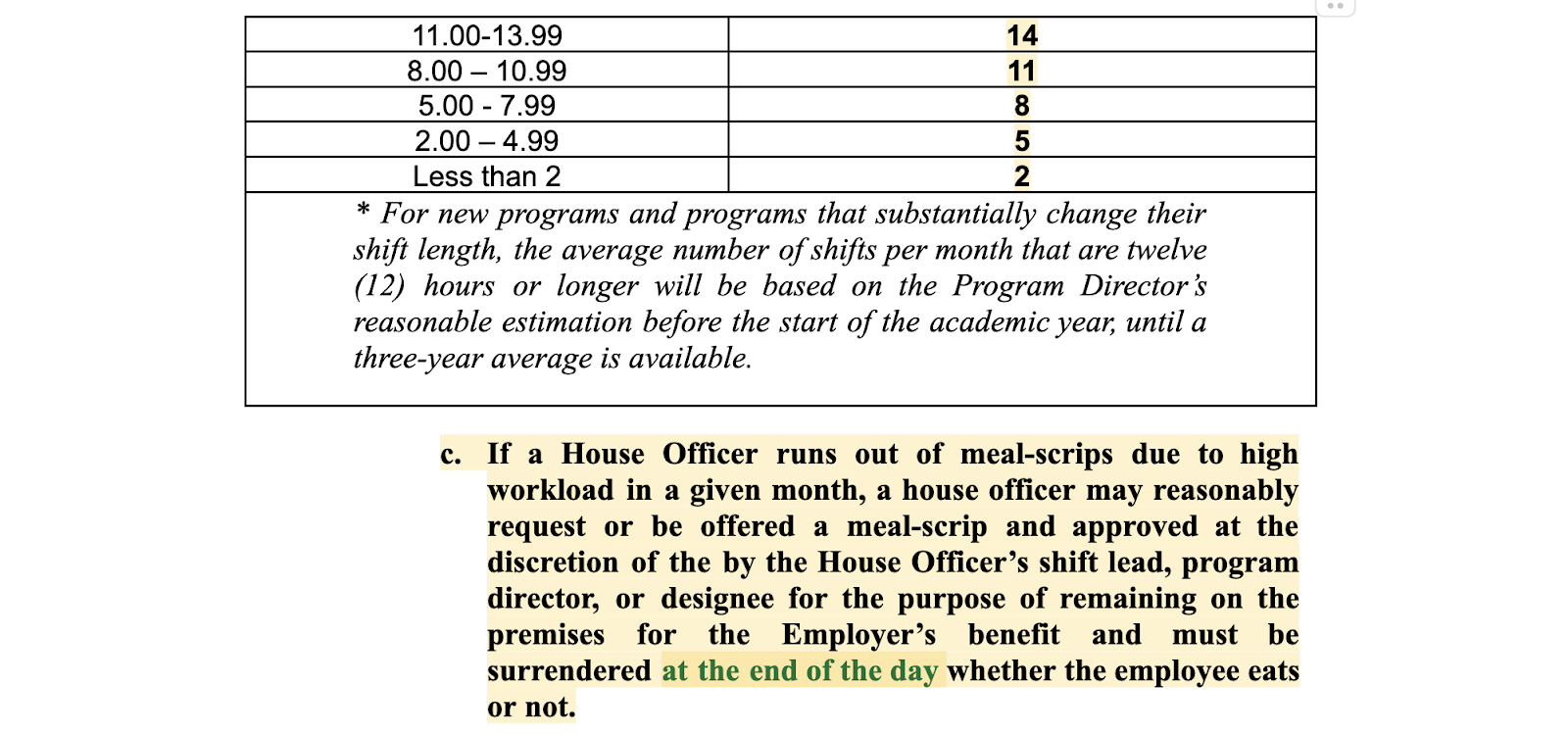

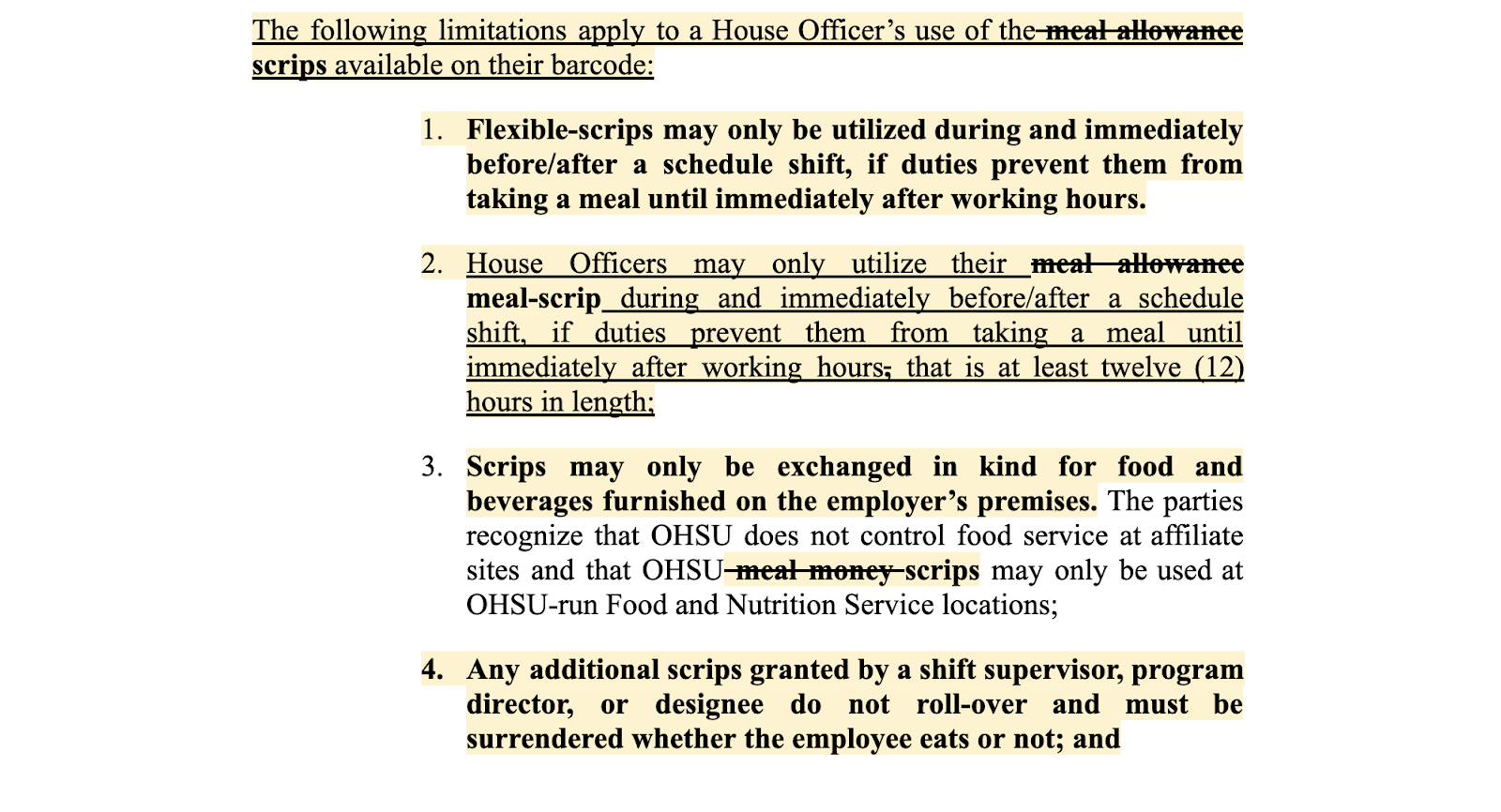

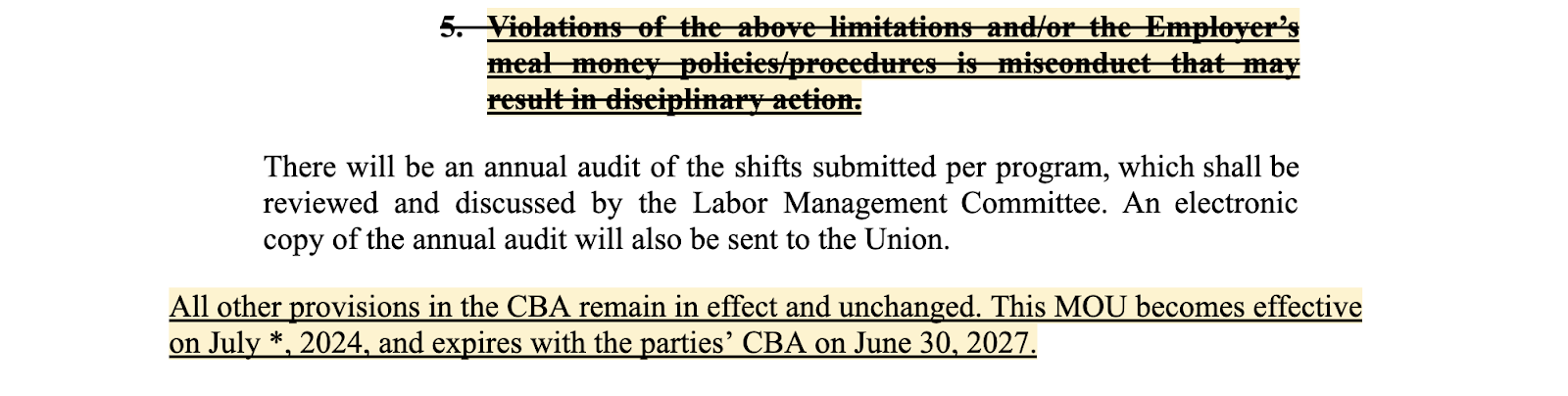

We are responding to OHSU’s announced implementation changes to our meal money benefit. Earlier this academic year, it came to the attention of OHSU that our meal money is not exempt from federal and state income taxes. Neither party foresaw this during our previous negotiations of our contract last year. OHSU approached us with proposed changes to meal money articles with an effort to meet the tax code (IRC Sec 119) criteria for tax exemption. After lengthy discussions, neither party was confident that OHSU’s proposal would meet that criteria and your union leaders felt the changes were unnecessarily restrictive. OHSU is implementing taxation on meal money moving forward as required by law as we continue with our discussions on this article. However, taxing per OHSU’s proposal means our buying power for meals will be even less than it currently is with cafeteria prices. We proposed 2 options for OHSU to consider, but have received no response. Below is a summary of all options that have been discussed:

OHSU unilaterally moved forward with implementation changes to comply with the federal tax regulations– we understand that. However, OHSU also had the opportunity to provide some relief to house officers by agreeing to our option 2 in the interim as we continued working on a better solution. A 5% discount is not only reasonable, but something that is standard practice for other hospitals like Legacy Health, who provide discounts for employee payroll deductions when purchasing food at their cafeterias.

We are negotiating for further changes, but this will take some more time. We will keep you informed of further updates. Please reply with any questions.

Yours in solidarity,

Your Union Leadership

Our Proposal Below: